Accounting / Contracting Guide

Accounting and Contracting for festivals and events is a major element that needs to be considered well ahead of any agreements, to protect the producer and the client. Having a reliable accounting method and a solid contracting policy will go a long way to ensure budgets are properly handled and there are no liability or payment term issues with vendors and artists.

Event and Festival Accounting

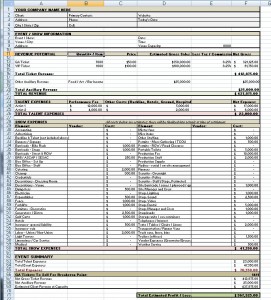

- Creating / updating a master P & L / budget for the event / festival

- Normal fixed costs for events

- Venue rental, artist fees, permits

- Normal variable costs for events

- Staffing costs, furniture rentals, site related rentals (fencing, bike rack, etc), music licensing, insurance

- Normal sources of income for events

- Percentage of revenue from bar, food, art/craft, and/or merch vendors

- Ticket sales

- Sponsorships

- Ad revenue from website, mobile app

- Determining a realistic break-even point

- Utilize the document below to help determine how much you need in income in order to break even given your estimated expenses – and remember that the best policy is to not rely on sponsorship income at all to hit your break-even point, because it is not a given.

- Below is an example of a P & L / budget (download it here – .xls format) – the event information is blank but some elements have been filled in as examples so you can see how the formulas work.

- Normal fixed costs for events

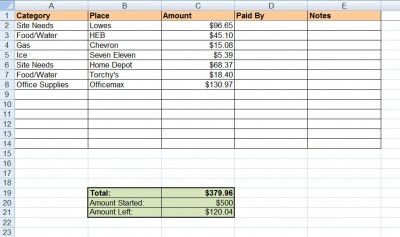

- Providing petty cash / float for run of show festival needs

- A necessity for most events, this is usually this is coordinated with the festival or office manager, and they will bring back any unused petty cash / float as well as all receipts to accounting for proper filing.

- Sometimes debit / credit cards are used in place of petty cash.

- Download a simple petty cash template in .xls format

- Payroll or not for employees / temp labor

- Discuss the pros and cons of having your staff on payroll (and taking out taxes) vs. paying them all as independent contractors

- Pros: easier to get them paid; they don’t have to submit an invoice and accounting doesn’t have to cut a check for each individual person

- Cons: may cost more to keep the third party payroll company handling the administration of this; with contract pay, the contractor worries about taxes and other expenses.

- Discuss the pros and cons of having your staff on payroll (and taking out taxes) vs. paying them all as independent contractors

- Collecting W9s for all staff

- Download the latest W9 direct from the IRS

- Creating terms / conditions for vendors, artists, staff

- Examples of contracting terms and conditions – coming soon

- Work with the Contracting department

- Determining who needs deposits and how to settle with vendors / artists

- When possible, a 50% deposit with 50% paid net 30 is preferred for vendors. This allows the vendor to cover upfront costs and also gives the buyer flexibility – especially if the scope of services changes during run of show, affecting the final cost – and time to properly close out the event before having to cut final checks.

- For artists, a deposit (ranges from 10% to 50% normally, and is usually agency specific) is normal with the balance paid either in cash, wire, or company check day of show. Often accounting will cut the checks and hand them over to the stage manager for payment. Some events also require the payee to sign a receipt / proof of payment slip.

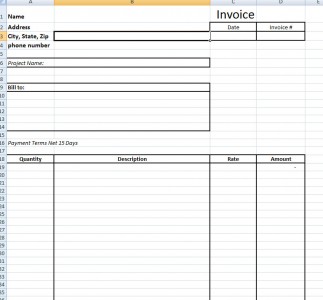

- Examples of other Accounting Documents

- Download an invoice template – .xlsx format

- Download an invoice template – .xlsx format

Vendor and Staff Contracting

- Vendor Contracting

- Determine your terms and conditions for vendors to apply

- Create a contract for them to sign that properly covers liability for the event

- Determine insurance requirements for the vendor.

- Include payment terms and any other requirements

- You may wish to put a vendor on a “blanket contract” if you plan on utilizing them for multiple events, with the only things changing each time is the scope of work / services provided but all other legal and insurance related terms stay the same.

- After they sign it, they will need to send you an invoice – if they have sent you just a quote previously, they will need to send a formal invoice.

- After they complete their agreed upon work, accounting remits payment.

- Staff Contracting

- Determine your procedure; many events handle staff contracting as such:

- Send the staff person an Independent Contractor’s Agreement that includes their pay and payment terms

- Some events will also require the contractor to sign an NDA and/or liability waiver (especially if they do not have personal insurance)

- After they sign it, they need to send you an invoice

- After a properly completed job, accounting remits payment

- Determine your procedure; many events handle staff contracting as such: